Exploring the intriguing world of BlackRock buying homes, this overview delves into the reasons behind their interest, the strategies they employ, and the implications on the housing market.

Overview of BlackRock Buying Homes

BlackRock, a global investment management corporation, has a long history of involvement in real estate, including residential properties. The company has been actively participating in the real estate market for several years, acquiring properties for various investment purposes.

BlackRock's interest in purchasing homes stems from the potential for generating attractive returns on investment. By acquiring residential properties, the company can benefit from rental income, property appreciation, and other financial opportunities within the real estate sector.

Impact of BlackRock’s Home-Buying Strategy on the Housing Market

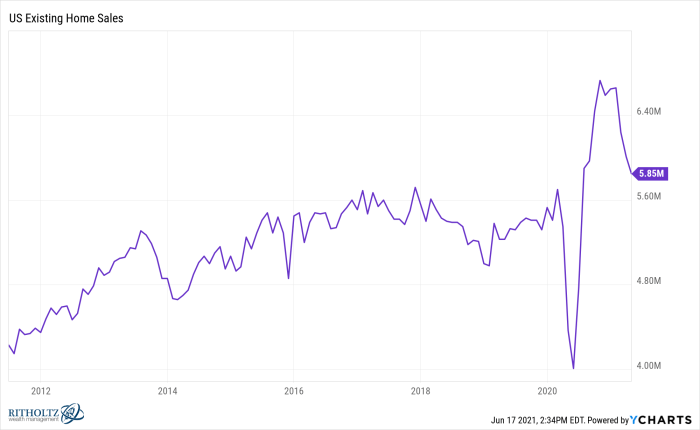

BlackRock's home-buying strategy has had a significant impact on the housing market, influencing various aspects of supply, demand, and pricing dynamics. Some key effects of BlackRock's activities in the housing market include:

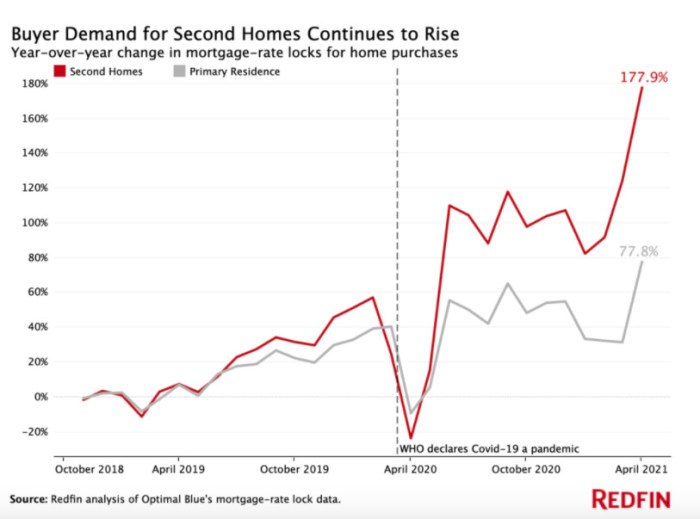

- Increased competition: BlackRock's presence in the market can intensify competition for available properties, potentially driving up prices and limiting affordability for individual homebuyers.

- Market trends: The company's large-scale acquisitions can influence market trends and property values in certain regions, shaping the overall real estate landscape.

- Rental market dynamics: BlackRock's rental properties can impact the rental market dynamics, affecting rental rates and availability in specific areas.

- Investor influence: As a major player in the real estate investment sector, BlackRock's actions can have broader implications for investor behavior and market perceptions.

BlackRock’s Investment Strategy

BlackRock's investment strategy in buying homes involves a systematic approach to identifying properties for purchase, financing acquisitions, and weighing the potential risks and benefits associated with their investments.

Identifying Properties for Purchase

BlackRock utilizes data analytics and market research to identify properties that meet their investment criteria. They look for homes in desirable locations with the potential for long-term appreciation and rental income.

Financing Home Acquisitions

BlackRock typically finances its home acquisitions through a combination of cash reserves and leveraging. By using a mix of equity and debt, they aim to optimize their returns while managing risk effectively.

Potential Risks and Benefits

- Benefits:

• Diversification: Investing in real estate provides BlackRock with a diversified portfolio that can hedge against market volatility in other asset classes.

• Income Generation: Rental income from properties can provide a steady cash flow stream for BlackRock.

- Risks:

• Market Fluctuations: The real estate market can be subject to fluctuations, impacting the value of BlackRock's property investments.

• Regulatory Changes: Changes in regulations or policies can affect BlackRock's operations and profitability in the real estate sector.

Effects on the Real Estate Market

BlackRock's large-scale home purchases have significant effects on local real estate markets, impacting various stakeholders and driving changes in housing dynamics.

Implications for First-Time Homebuyers and Renters

BlackRock's massive acquisitions of single-family homes can pose challenges for first-time homebuyers and renters. As BlackRock competes in the market, it can lead to increased prices and reduced inventory, making it harder for individuals looking to purchase their first home or find affordable rental options.

Long-Term Consequences on Housing Affordability

The long-term consequences of BlackRock's activities on housing affordability are concerning. By purchasing a large number of homes and potentially converting them into rental properties, BlackRock may contribute to the overall rise in housing costs. This can further exacerbate the affordability crisis, making it increasingly difficult for individuals and families to find suitable housing options within their budget.

Public Perception and Criticisms

As BlackRock continues its aggressive buying of homes across the country, public perception has been mixed. Some view BlackRock's actions as a savvy investment strategy that takes advantage of a booming real estate market, while others criticize the company for contributing to the affordability crisis by driving up home prices.

Perception of BlackRock’s Home-Buying Spree

Many people see BlackRock's home-buying spree as a sign of the growing influence of large institutional investors in the housing market. Some applaud BlackRock for recognizing the investment potential in residential real estate, while others express concern about the impact on regular homebuyers and renters.

Criticisms and Controversies

- One major criticism of BlackRock's real estate investments is the potential negative impact on housing affordability. By purchasing large quantities of homes, BlackRock may be contributing to the rise in home prices, making it harder for individuals and families to afford a home.

- Another controversy surrounds the issue of market manipulation. Some critics argue that BlackRock's massive buying power gives the company an unfair advantage in the housing market, potentially distorting prices and creating an uneven playing field for other buyers.

- There are also concerns about the impact of BlackRock's actions on rental markets. As BlackRock acquires more single-family homes, there is a fear that this could lead to a decrease in rental availability and an increase in rental prices, further exacerbating the housing crisis.

Regulatory and Ethical Considerations

From a regulatory standpoint, BlackRock's real estate investments have raised questions about the need for increased oversight of large institutional investors in the housing market. Some advocate for stricter regulations to prevent monopolistic behavior and ensure fair competition.

On an ethical level, there are debates about the social responsibility of companies like BlackRock in the housing sector. Critics argue that BlackRock has a moral obligation to consider the broader societal implications of its actions and prioritize the well-being of communities over profit margins.

Final Wrap-Up

In conclusion, the phenomenon of BlackRock buying homes sparks debates about affordability, market dynamics, and ethical considerations, leaving a lasting impact on the real estate landscape.

Essential FAQs

How long has BlackRock been involved in real estate?

BlackRock has been actively involved in real estate since [insert year], primarily focusing on [specific aspect of real estate].

What are the potential risks associated with BlackRock's investment strategy?

The risks associated with BlackRock's investment strategy include [list potential risks], which may impact [specific aspect of the market].

How does BlackRock finance its home acquisitions?

BlackRock typically finances its home acquisitions through [explain financing methods], allowing them to expand their real estate portfolio.